Introduction:

In today’s fast-paced world, getting a good night’s sleep is more important than ever. After all, quality sleep is the foundation of a healthy and productive life. If you’re in the market for a new bed, look no further than the beds for sale near you. With a wide

Versatile Comfort Queen Daybeds for Stylish Living Spaces

Introduction:

In the realm of interior design, the queen daybed stands as a versatile and stylish piece of furniture that adds both comfort and functionality to modern living spaces. With its spacious dimensions and chic design, the queen daybed offers a myriad of possibilities for creating stylish and inviting living

Luxurious Living Curved Couches for Elegant Home Décor

- Luxurious Living: Curved Couches for Elegant Home Décor

- Embrace Elegance: Stylish Curved Couches for Your Space

- Curved Couches: Elevate Your Living Room Design

- Contemporary Comfort: Curved Couches for Modern Homes

- Curved Couches: Enhance Your Interior with Sophistication

- Chic and Comfortable: Curved Couches for Stylish Living

- Curved Couches: Transform Your Space

Transform Your Space with a Versatile Sectional Sofa Bed

Transform Your Space with a Versatile Sectional Sofa Bed

Sub Heading: The Perfect Blend of Form and Function

When it comes to furnishing your living space, finding the right balance between style and practicality is essential. Enter the versatile sectional sofa bed – a piece of furniture that effortlessly combines

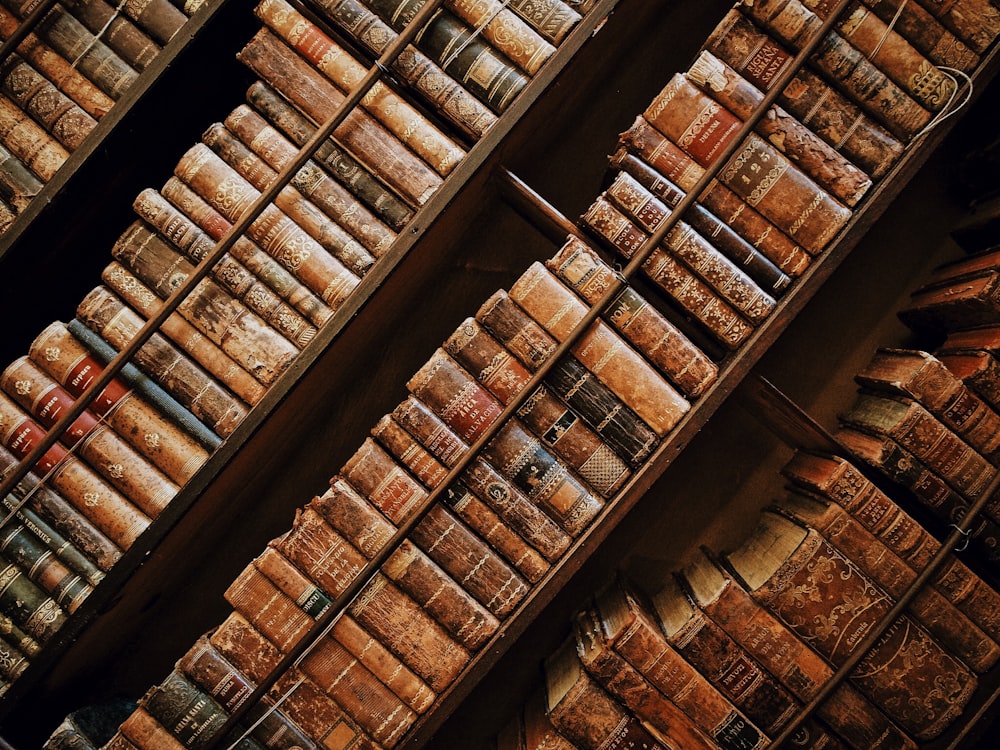

Stylish Bookcase with Doors Organize Your Space Effortlessly

Subheading: Elevate Your Home Organization

In the quest for a well-organized home, finding furniture that seamlessly combines style and functionality is essential. Enter the stylish bookcase with doors – a versatile piece of furniture that not only adds aesthetic appeal to your space but also helps keep clutter at bay.

Explore Comfort and Style with IKEA Chairs Collection”

Subheading: Elevate Your Seating Experience

When it comes to furnishing your home, comfort and style are paramount. With the IKEA chairs collection, you can effortlessly elevate your seating experience while adding a touch of Scandinavian flair to your space. Whether you’re looking for a cozy armchair for your living room,

Stylish Storage Solution Round Coffee Tables with Storage

Elevating Living Spaces with Round Coffee Tables

In the realm of interior design, round coffee tables with storage are emerging as stylish storage solutions, adding both functionality and elegance to living rooms. Let’s explore the versatility and appeal of these furnishings, along with their ability to enhance the organization and

Luxe Swivel Accent Chair Elegant Comfort for Any Space

Introduction:

In the realm of interior design, finding that perfect balance between style and comfort can sometimes feel like an elusive quest. However, with the Luxe Swivel Accent Chair, this search just might come to a luxurious end. Crafted with both elegance and comfort in mind, this chair effortlessly elevates

Sink into Comfort Explore Our Comfy Couch Collection

Sink into Comfort: Explore Our Comfy Couch Collection

Subheading: The Importance of Comfort in Home Design

In the realm of home design, comfort is king. After a long day at work or a busy day running errands, there’s nothing quite like sinking into a cozy couch and unwinding. That’s why

Embrace Contemporary Style with Modern Bedroom Furnishings

Introduction:

In the realm of interior design, the bedroom serves as a sanctuary for relaxation and rejuvenation. To create a space that reflects contemporary style and sophistication, modern bedroom furnishings play a pivotal role. Let’s delve into the world of modern bedroom furnishings and explore how they can help you